Cookies help us deliver our services. By using our services, you agree to our use of cookies.

You have no items in your shopping cart.

Filter by price

Filter by manufacturer

Trend Indicators

In trading, trend refers to the direction of the price movement over an extended period of time. For example, when the price is consistently increasing, it’s an uptrend, and when it’s decreasing, it’s a downtrend.

Trend indicators can help determine the direction the market will take.

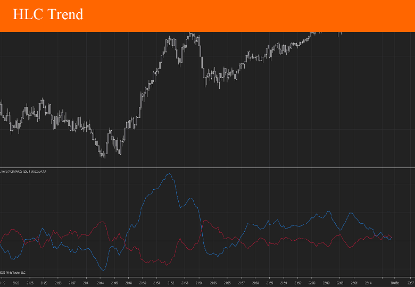

HLC Trend

The HLC Trend Indicator is a technical analysis tool used in trading to identify trends and potential entry/exit points in the market. It is based on the High, Low, and Close (HLC) prices of an asset, which are key components of candlestick or bar charts

$9.90

Ergodic Tick Volume Indicator

The William Blau Ergodic Tick Volume Indicator is a variation of the Ergodic Oscillator developed by William Blau. It uses tick volume instead of price for its calculation, making it particularly useful for traders who focus on volume-driven signals rather than price action alone.

$9.90

Williams %R with Bollinger Bands

The Williams %R w/ Bollinger Bands indicator is a combined technical analysis tool that overlays the Williams %R momentum oscillator with Bollinger Bands to enhance the identification of overbought and oversold market conditions.

$9.90

Moving Average Slope

The MA Slope indicator (Moving Average Slope) is a technical analysis tool used in trading and investing to measure the direction and steepness (rate of change) of a moving average over time. Instead of just tracking the value of a moving average (like SMA or EMA), the MA Slope indicator quantifies how quickly that average is rising or falling—essentially, it calculates the gradient or "slope" of the moving average line.

$9.90